As July 2025 comes to a close, many Social Security beneficiaries will find that they won’t receive any further deposits for the month. The Social Security Administration (SSA) follows a strict payment schedule, which typically remains consistent month to month, except for holidays and weekends. With all scheduled payments already issued, some individuals will have to wait until August for their next deposit.

Understanding the SSA Payment Schedule

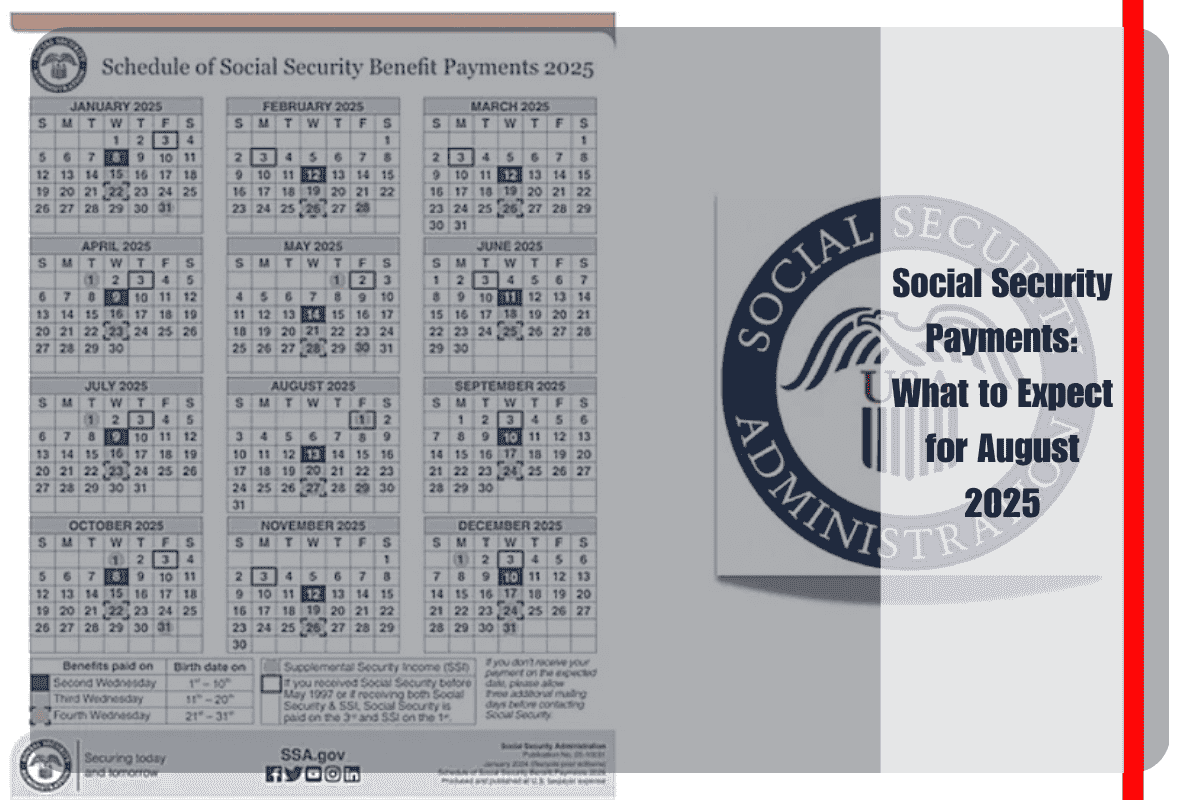

The SSA operates on a well-established payment schedule, which varies depending on the type of benefits you receive and your birth date. Here’s a breakdown of when you can expect your payments:

Retirement and SSDI Beneficiaries:

Second Wednesday of the month: For those born between the 1st and the 10th of the month.

Third Wednesday of the month: For those born between the 11th and the 20th.

Fourth Wednesday of the month: For those born between the 21st and the 31st.

SSI Beneficiaries:

SSI payments are issued on the 1st day of each month.

If you also receive retirement benefits, your payment is issued on the 3rd of the month.

If you began receiving retirement benefits before May 1997, your payment also falls on the 3rd.

When Will Social Security Payments for August 2025 Be Issued?

The last payment for July 2025 was made on Wednesday, July 24. Here’s what the payment schedule looks like for August:

Thursday, August 1: Payments for those who receive SSI exclusively.

Saturday, August 3: Payments for those who receive both retirement benefits and SSI or for those who started collecting retirement benefits before May 1997.

Wednesday, August 14: Payments for those born between the 1st and the 10th of the month.

Wednesday, August 21: Payments for those born between the 11th and the 20th.

Wednesday, August 28: Payments for those born between the 21st and the 31st.

How Much Can You Expect in Your August 2025 Social Security Payment?

The amount you’ll receive depends on various factors, including your work history and when you start claiming benefits. In 2025, the maximum Social Security payment is $5,108 per month. However, most beneficiaries receive an average of $2,000 per month.

To receive the maximum benefit:

You must delay claiming benefits until you turn 70 years old.

You need to have paid Social Security taxes for at least 35 years.

You must have 40 work credits.

You must have paid Social Security taxes throughout your working life.

If you’re unsure of your payment schedule or need more information, it’s always a good idea to visit the official SSA website at SSA.gov or consult with an authorized representative for further assistance.